A recent blog post called The Entrepreneurial Diaspora Enabled By Biotech M&A by Bruce Booth, a Partner at Atlas Venture, got me thinking about leadership talent in biotech hubs. Bruce talks about the “recycling” of talent from existing biotechs to new startups after M&A and provides some interesting examples from teams at companies in the Atlas portfolio. The last full paragraph was what really caught my eye:

In less established biotech clusters, the lack of this “success diaspora” is a serious limitation. Not only does it impact the current biotechs, but it prevents the inter-company transfer of the hallmarks of success that help shape the winners of tomorrow. Figuring out how to access these insights is an imperative for clusters that don’t have a steady flow of deal-enabled entrepreneurial movement.

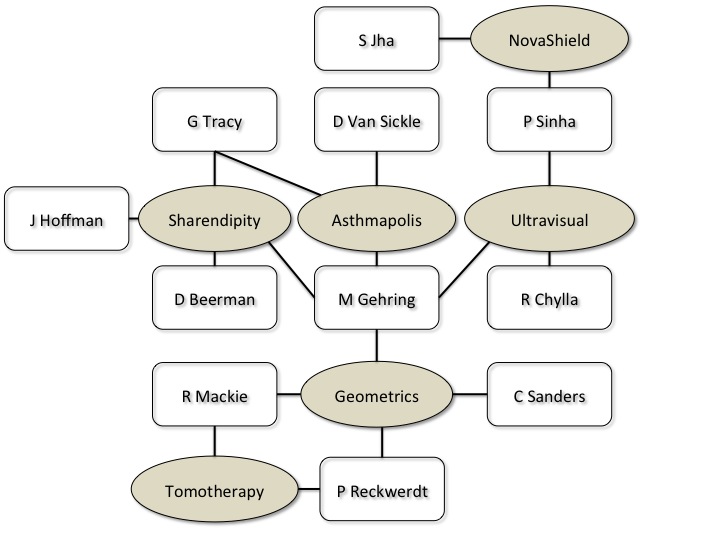

In Madison, we have a good history of biotech founders and management moving from one company to another, carrying their knowledge and skills forward each time. While there are many possible “WI biotech family tree” examples, I’ve used Geometrics, a company founded in 1992 that developed a 3-D radiation therapy planning system. As you can see, the founders have continued to move through the local startup community. Expanding the pool beyond founders to management teams would provide an even deeper pool of talent.

- Geometrics – Founded 1992 – Acquired first 1996 – Now part of Phillips Healthcare

- Tomotherapy – Founded 1997 – IPO 2007 – Acquired by Accuray 2011

- Ultravisual Medical Systems – Founded 2000 – Merged first 2003 – Now part of Merge Healthcare

- Sharendipity – Founded 2006

- NovaShield – Founded 2005

- Asthmapolis – Founded 2010

As I got to thinking more about developing biotech entrepreneurs and leaders, I got stuck on the idea of recycling, which turned into Recycle, Reuse, Reduce.

The following thoughts are not meant to convey the idea that any one path is inherently better than another. Identifying areas for improvement is a key to building established biotech clusters – the premise behind champion vs. cheerleader.

Recycle efficiently: Return to a previous stage in a cyclic process

Madison has had some strong exits, allowing talent and capital to turn over. But I have a sense that the recycling of talent is not as efficient in Madison as in larger clusters such as Boston. My theory is places with more efficient capital markets are more efficient at recycling talent.

Much of the funding for new biotech companies in Madison comes from individual investors, whether individuals or as part of angel groups. Indeed, there is only one venture capital fund in Madison. (I limited to VC funds that clearly raised the majority of their capital from institutions rather than individuals.) For additional perspective, VC investment in WI across industries was $72 million in 2011. Hence for released talent, getting funding to launch a new effort or finding an existing opportunity that is a good fit can be time consuming even with a successful exit.

While capital is constrained across the investing spectrum, there are potential benefits of scale that capital rich markets have. As an example, venture capitalists have the capacity to bring on talent and have management that can bridge across companies until there is critical mass requiring full time effort at a single company. This approach could be achieved through a full time entrepreneur-in-residence or with a consultant offering a commitment that may later become full time. Such arrangements are more straightforward (and more likely) when the companies and investors are located in the same city.

Reuse existing resources: Use more than once

Less established clusters may not have a critical mass of biotech leadership talent. A solution is to “reuse” talent from more established sectors in the community to help build biotech talent. When I pitch this idea, many folks push back with the differences between biotech and other industries – the long timelines, regulatory burdens, high capital needs. Having benefited from “reusing” talent, I’ve found that the benefits of the parallels between businesses in different industries are more powerful than the limitations of direct overlap. There are a number of ways to cross-pollinate, including peer learning groups and more traditional mentor programs.

I’ve been fortunate to be a part of two such groups: Peerspectives and Executive Agenda. The groups provide a variety of perspectives from large and small companies, services to products, manufacturing to software to construction. The composition of the groups and format for the meetings is different but the fundamentals are the same – no overlapping business interest avoids conflicts and confidentiality is paramount.

Another method to reuse existing resources is mentoring. I recently wrote about my experience as part of a formal mentoring program for entrepreneurs where the matches are based on skills needed as opposed to industry overlap. As an example, I’ve been on a mentor team for a software company that was interested in raising money from individual investors.

(In addition to providing learning opportunities, these groups also provide another important feature: camaraderie. Sometimes being an entrepreneur and/or a leader can be a lonely endeavor.)

Reduce, aka the retention issue: Make smaller or less in amount

One of the issues less established communities face as exits occur is talent reduction. You may hear about this issue from another perspective: the challenges of recruiting talent to places without a critical mass of companies. The same principle applies to home grown talent. Other parts of a community need to be strong enough to allow for a next opportunity. While loss of talent is something to avoid, there are potential benefits, primarily cross-pollination across geography rather than industries.

An example of Madison based talent reduction is Schaefer Price, President & CEO of Pharmasset. Price was President of Powderject Vaccines in Madison from 1997 to 2001. After that, he was an entrepreneur –in-residence at Bay City Capital. While the goal would be to have the next company built in Madison, exporting talent can help build bridges across geography. Since relationships are local, having the trust of peers who know you can be helpful for a variety of activities, including funding and recruiting. Building on these relationships is a key to capitalize on talent reduction.

Next Steps

Exits are an important part in freeing up capital and talent, but they are difficult to impact indirectly. Fortunately, there are alternatives to help build leaders in less established clusters.

Great post, Laura!

The network graph of companies and managers is cool. I’d love to see that data for other cities and do state-by-state comparisons.

I can’t help but draw parallels between Industry and Academia. I see so much inefficiency and missed opportunities resulting from the “go it alone” approach that dominates many biology departments. We need more openness and teamwork.

What do you think of the free agent model espoused by the Kauffman Foundation? http://www.insidehighered.com/news/2012/05/04/senate-bill-hopes-speed-technology-licensing-process

Thanks Ethan.

I’m working on some additional trees that include management as well as founders. I think the visuals are compelling in support of recycling.

That article was interesting. There are clearly differences in efficiency/production between tech transfer offices at various universities. A mechanism to ensure that technologies can move efficiently from research to commercialization would seem to benefit everyone. A concern about the free agent model could be the shift of the burden onto professors whose time appears to be already be filled with writing grants and papers, teaching and managing their research groups.

Overall, I like the idea of allowing multiple pathways to get technology to commercialization but perhaps there are other stakeholders who could help with the heavy lifting.

Interesting info; thanks!

Interesting post Laura. We have a very close connection to the European biotech clusters and it is very interesting to observe the way in which teams, to a great extent, follow each other from venture to venture with confidence in each other’s abilities.

However, what the industry needs is also the infusion of other ideas and skills from other regions to create the right blend of expertise to construct that particular venture. While it is in the interests of clusters to hold onto the best and brightest, it also serves the industry very well for this cross-pollination to occur.

Pingback: 2013 in the Rearview | The Next Element

Pingback: Update from the Swirl (and People are Key to Success) | The Next Element